America's New "Physical Software" Layer

Our ability to close the gap between physical reality and digital visibility will help determine the extent of America’s industrial renaissance.

After decades of offshoring, the United States is in the middle of a real, measurable industrial comeback. New semiconductor fabs, EV battery plants, and defense production lines are breaking ground across the country. Reshoring initiatives and historic federal investment have opened the eyes of public and private investors and fueled an aggressive race to build the infrastructure to power America’s industrial ecosystem.

But investment in physical infrastructure will only take us so far – we also need much improved data infrastructure to power software, communications, and financial services.

Most factories, warehouses, and logistics networks still run on siloed systems that produce lagging indicators. America’s industrial decision-makers are informed by Electronic Data Interchange (EDI) feeds that arrive overnight, PDFs that need to be re-keyed into an Enterprise Resource Planning (ERP) system, and spreadsheets stuck in emails between operations and finance. As nVision Global put it, the industry’s biggest weakness “isn’t a lack of technology, it’s a lack of connection.”

The numbers back up this qualitative story. Roughly 60% of business data in logistics still shows up in incompatible formats like PDFs and scanned documents. Nearly two-thirds of supply chains are labeled “fragile” by their own operators because they lack real-time visibility. A recent study from JBF/Pando showed that 83% of logistics leaders said data quality is the biggest barrier to AI adoption. We’ve built more computing power than any generation in history, and yet a shocking amount of the data that powers real world outcomes exists offline.

Our ability to close the gap between physical reality and digital visibility will help determine the extent of America’s industrial renaissance.

The technology now exists to create America’s new physical software layer – the API fabric that connects physical goods, machines, and infrastructure to software in real time. By instrumenting the physical world with sensors, computer vision, and robotics, then coordinating it with AI, we can streamline processes across heavy industry.

Shifting Trade Relationships Closer to Home

The global trade map is reorganizing into regional blocs. For the U.S., the relevant story is the rise of the U.S.-Mexico-Canada corridor.

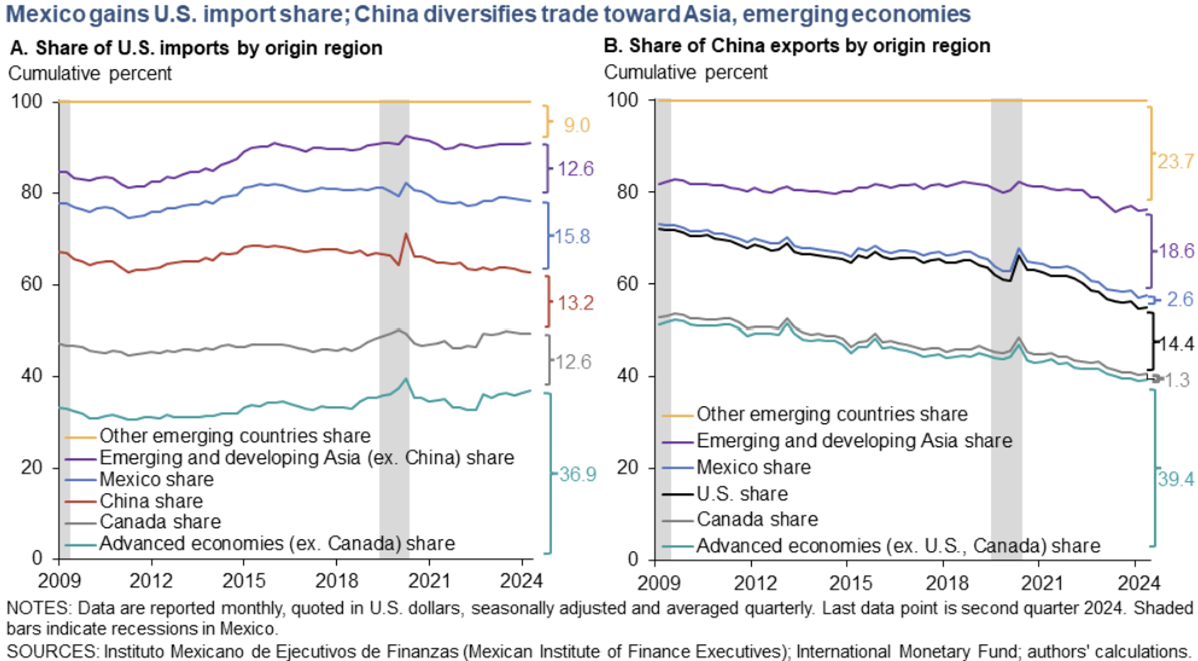

In 2023, Mexico surpassed China as America’s largest trading partner. Mexican exports to the U.S. hit a record ~$475 billion, and manufacturing Foreign Direct Investment (FDI) into Mexico has been growing ~20% annually since 2019 – nearly 3x the global average. Mexico’s share of U.S. imports has risen from ~13% to almost 16% since 2017, while China’s has fallen from above 21% to nearly 13%. “Deglobalization” does not mean the end of trade – it’s a rewiring of who trades with whom.

U.S. policy is reinforcing the shift. The USMCA, passed in 2019, updated NAFTA’s rules and regulations for a world with tighter rules-of-origin requirements and closer integrations between North American trade partners. The CHIPS Act and IRA have contributed hundreds of billions of dollars towards domestic capacity and “friendshored” supply chains.

The goal is to produce shorter supply lines, tighter geographic clusters, and more resilient production. But whenever supply chains shift, new risks crop up that must be solved for. When your parts move from Shenzhen-to-LA-to-Kentucky, you’re dealing with one set of interfaces and data gaps. When those same parts move Monterrey-to-Laredo-to-Ohio, the players change, the infrastructure changes, and the failure modes change. For companies managing thousands of SKUs, this transition takes significant time and investment to ensure supply chain durability.

The only way this new North American production bloc works at scale is if data passes cleanly across every handoff – this includes the software and embedded financial solutions that power the industry, as well as the border crossings, cross-docks, 3PLs, and plant gates that help move goods.

Demographics, Fintech, and the Cost of Flying Blind

There are three more structural macro forces at play here that raise the stakes further: an aging workforce, embedded fintech, and energy volatility.

Nearly one-quarter of the U.S. manufacturing workforce is already 55 or older. By 2030, one in five Americans will be 65+. The operators who bring the tribal knowledge to the industrial ecosystem are retiring. If their knowledge isn’t captured as data and encoded into systems, it will not be adequately replaced.

At the same time, the flow of money is moving closer to the flow of operations. Logistics platforms are offering instant factoring against loads. New-age ERPs are shipping products with payments built in. B2B embedded payments are projected to reach on the order of tens of trillions of dollars by 2030. That only works if the financial systems can trust the physical ones: e.g. is the inventory where it’s supposed to be, did the truck actually deliver, did the plant really produce the contracted megawatt-hours. Real-time finance requires real-time data.

Data also impacts energy utilization. Utilities historically over-forecast demand by roughly 1% per year, which translates to billions of dollars poured into unnecessary capacity. At the facility level, mis-forecasting demand means either buying peak power at painful prices or paying for capacity you don’t use.

The common thread across freight, labor, payments, and energy is simple: if you can’t see what’s going on, you will overbuild, overpay, and underperform.

The Price of the Observability Gap

In logistics, misclassified or mis-declared freight is a multi-billion-dollar problem. If a shipment’s weight or contents are recorded incorrectly, carriers will eventually catch it, and they’ll make you pay: reweigh fees, penalties, and even $5,000+ fines per container are common. A pallet that’s a few inches bigger than what’s on the paperwork can trigger a reclass. Shippers commonly wade through thousands of reclasses annually, draining millions of dollars per year.

Poor asset utilization is another invisible tax. An estimated 20–35% of U.S. truck miles are wasted on empty backhauls. Machines on the factory floor are idle more than they need to be because maintenance schedules, changeovers, and materials arrivals aren’t tightly coordinated. Every empty mile and idle hour is lost throughput.

At the border, a single customs paperwork error can hold a container at port for days. That translates directly to downed production lines, demurrage fees, and detention charges. Some studies peg a one-day customs delay as equivalent to a 1% tariff on trade. In a tight-margin business, that’s an existential tax.

Misrouted freight, idle trucks, stalled shipments, oversized power plants – they’re all symptoms of the same disease: a lack of real-time, integrated data about the physical world.

The Four Pieces of the Physical Software Layer

What exactly constitutes this emerging physical software layer? In practice, it is being built from four interlocking technology layers that together bridge the physical-digital divide:

1. Ground-truth data capture with computer vision

The first layer is smart vision. Cameras paired with powerful computer vision models can continuously capture granular data from real operations. Not just “there is a box here,” but this box, these dimensions, this barcode, this damage pattern.

One company effectively building this infrastructure is Dockware. They provide a fully automated, mounted sensor suite that captures shipment data (dimensions, physical condition, labels, symbols, and more) in real-time with no stops and no extra steps. That data is then pushed directly into the systems that rate, bill, and plan capacity. The result is lower mis-class fees, higher warehouse throughput, staff freed up for higher impact tasks, and customers who get their shipments faster.

Vision is the ground truth that every other layer builds on.

2. Continuous telemetry via edge IoT sensors

If cameras are the eyes, IoT sensors are the nerve endings. We already have more than 20 billion connected IoT devices in the world, heading toward ~40 billion by 2030. In manufacturing, the majority of plants have adopted some kind of shop-floor IoT: vibration sensors on motors, temperature probes on tanks, GPS trackers on trailers.

These devices stream a live feed of the physical state of the world. This is the difference between looking at last week’s production report and watching the factory as if it’s a Bloomberg terminal.

3. AI-native robotics and autonomous agents

The third layer is action. Once you can see what’s happening, you want agents that can act on it. That’s where AI-native robotics and autonomous systems come in.

In the warehouses of the future, autonomous mobile robots (AMRs) roam aisles moving goods. Drones fly automated patterns to scan barcodes and count inventory. Companies like Gather AI and Verity have shown that autonomous inventory drones can increase inventory accuracy and reduce “pallet not found” incidents by over 90%.

Aside from just moving boxes, robots are continuously writing data back into the system: what they saw, what they moved, what changed. They’re both actuators and data collectors.

4. Agentic automation to bridge legacy systems

Industrial America still runs on legacy software – mainframe-based Warehouse Management Systems (WMS), homegrown ERPs, arcane customs portals, green-screen terminal apps. They don’t have modern APIs, and they’re not going away anytime soon.

As I discussed in last week’s piece, agentic automation treats those systems as if they do have APIs.

An AI agent can read a PDF bill of lading, log into a government customs site, type the right values into the right boxes, and push status updates back into a Transportation Management System (TMS). Another agent can sit on top of a legacy maintenance system, watching for specific error codes and triggering work orders automatically.

This is what turns a collection of incompatible, legacy-heavy workflows into something software-addressable.

Why Now

None of these technologies are brand new in isolation. Cameras, sensors, robots, and RPA have existed for years. The difference now is threefold:

AI is finally good enough to make sense of messy real-world environments and unstructured data.

Costs have collapsed. Vision models and sensors can be deployed cheaply at industrial scale.

The macro pressure is real. Western manufacturers have to rebuild supply chains, deal with rising labor costs and retirements, and make good on hundreds of billions of dollars in subsidized capex.

The CHIPS Act, the IRA, and the infrastructure bill have collectively catalyzed over $600 billion in private clean energy and manufacturing investment and hundreds of thousands of new jobs. That’s the hardware: fabs, plants, ports, power lines.

But hardware alone doesn’t deliver productivity. The incentive structures behind those dollars – domestic content rules, on-time delivery requirements, emissions targets – implicitly assume a level of coordination that doesn’t exist today.

Policymakers have subsidized the concrete and steel. The market now needs to deliver the software and data that make those assets globally competitive.

Where Value Accrues

These technologies widen the aperture of physical sectors that can become software-addressable domains. When workflows are software-addressable, a few things happen:

Optimization becomes continuous instead of episodic.

Data compounds. Each additional process you digitize feeds models that improve everything else.

Industrial players shift their focus from financial engineering to physical throughput.

For founders and investors, this creates a clear opportunity set around the physical software layer:

AI-native WMS/TMS: Systems that assume real-time sensor and vision data as the default and constantly replan around it.

Robotic data capture and inspection: Drones, AMRs, and other form factors that turn dark corners of warehouses, yards, and plants into rich data streams.

Machine-readable customs and trade compliance: AI systems that ingest unstructured trade documents and automate cross-border flows, turning days of delay into minutes.

Embedded compliance and process co-pilots: Agents that sit alongside operations teams, watching sensor and video feeds to enforce safety, quality, and environmental standards in real time.

Predictive energy and maintenance layers: Lightweight AI that plugs into existing equipment and meters to optimize energy usage and uptime across fleets of assets.

The U.S. is in the middle of a once-in-a-generation rebuild of its industrial base. But we must build our data infrastructure with the same level of intentionality as we build our physical infrastructure. If we get it right, we won’t just have more plants, we’ll have smarter plants. That’s how you turn a construction boom into a durable productivity boom.