Stablecoins at Scale

Stablecoins are here to stay - the technologies that support its growth are still evolving.

I’ve launched my own Substack, where on a weekly basis, I’ll be analyzing specific macro topics through a bottom-up lens. The theme will be to define a particular macro trend, explain why it matters, and then highlight the specific technological & geopolitical components that facilitate its continued development. We’ll focus on sectors where inevitability meets technology - particularly within financial services, industrials, and healthcare.

The audience is intended to be far-reaching: novices & experts, builders & investors, macro & micro-oriented thinkers. I hope you enjoy reading them even a fraction as much as I enjoy writing them. Let’s get right to it.

On October 20, 2024, Stripe announced their acquisition of Bridge. This acquisition signified that stablecoins, once viewed as a niche instrument, were poised to play a central role in global money movement. A year later, we assess where the market stands and where it’s headed.

Stablecoins are cryptocurrencies designed to maintain a stable value, usually pegged to fiat currencies like the U.S. dollar. They now facilitate trillions in annual transactions and are projected to surpass $6 trillion per month in transaction volume by 2028, per Standard Chartered – an ~8x growth from current volumes. Growth will be driven by consumer and business adoption and familiarity with the asset class – but more importantly, it will be driven by continually improving infrastructure that makes transacting in stablecoin a more viable option.

In this piece, we examine what makes stablecoins compelling, define the layers of infrastructure that power stables, and assess how the infrastructure that supports them is evolving.

Why Stablecoins Matter

Stablecoins merge fiat stability with digital asset efficiency. Their rise can be attributed to three main factors:

Speed and availability: Transfers settle instantly, 24/7, eliminating the delays of traditional rails like SWIFT or ACH.

Low costs and disintermediation: By cutting out intermediaries, stablecoins offer the potential* to reduce wire fees, FX spreads, and cross-border friction (*Note: more on this later).

Protection against inflation: In emerging markets, USD-backed stablecoins protect against local currency volatility.

Over 99% of the stablecoin market is currently USD-pegged. If that dominance persists, rising volumes could reinforce U.S. dollar strength globally, which would be particularly timely as geopolitical tensions and tariffs otherwise erode it. Regulators are already attuned to the role stablecoins play in currency competitiveness, as we discuss in greater detail later on in this piece.

The Stablecoin Stack

Stablecoins exist within a broader “stack” of infrastructure and services that make them useful. Each layer presents different dynamics and opportunities for defensibility and disruption.

1. Issuers

What they do: Create and manage stablecoins by holding reserves, ensuring redeemability, and maintaining trust.

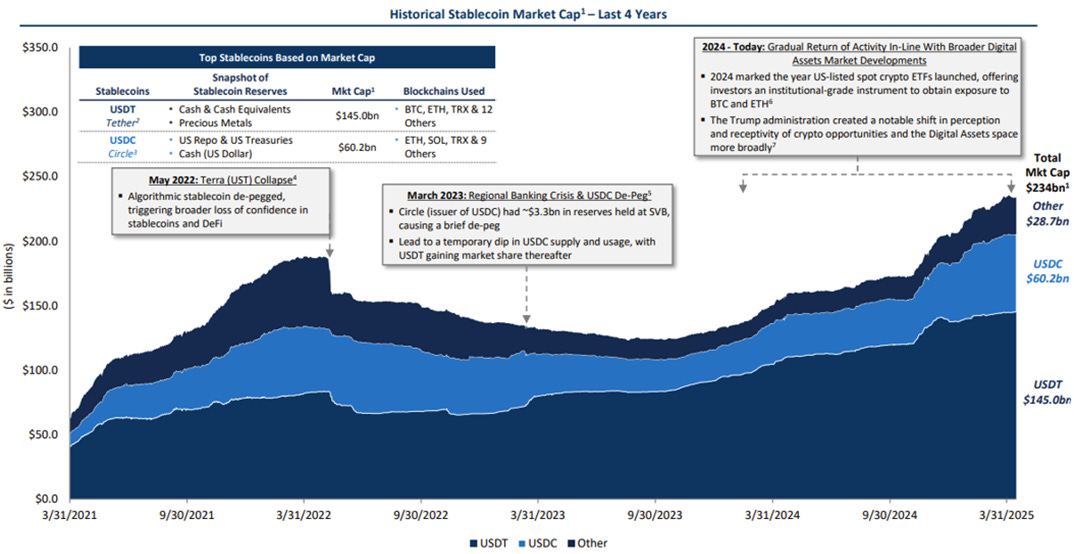

Examples: Tether (USDT) and Circle (USDC) control over 85% of market share. Circle has built deep institutional relationships (e.g., Visa, BlackRock), while Tether dominates emerging markets, where USD access is scarce.

Business model: Issuers primarily monetize through interest on reserves. With billions in assets under management and U.S. interest rates at a local maximum, this has been a very high-margin business over the past few years.

Opportunity: Trust, liquidity depth, and network effects have protected incumbents to date. But as the saying goes, “your margin is my opportunity” – and with improving infrastructure such as Stripe’s newly announced Open Issuance powered by Bridge, getting a new stablecoin to market has never been easier.

Other factors could further squeeze margins in this segment. For example, if U.S. interest rates fall over the coming 24 months as projected, this directly impacts USD-pegged Issuers’ business models. Additionally, U.S. law from the GENIUS Act prohibits issuers from offering “yield” in the form of cash back to their customers, but many are already relying on rewards to circumvent that law in an attempt to gain market share, further corroding Issuers’ margins.

2. Payments Infrastructure

What they do: Leverage stablecoins to enable fast, low-cost B2B and cross-border transactions.

Examples: Companies like Stellar, Ripple, and a host of regional startups focus on cross-border remittances and payroll flows. Some fintechs, such as Rain, integrate stablecoins directly into consumer card products.

Business model: Payments firms monetize through transaction fees, FX spreads, and API calls.

Opportunity: Early stablecoin payment providers have often-times built platforms that look and feel like fiat rails, but are powered by stablecoins. Since >90% of cross-border payments are B2B, mostly in legacy sectors like manufacturing and agriculture, the target customer segment here has low willingness to transact in a “new currency” – but when marketed simply as a cheaper, faster way to transact, they see tremendous value in these platforms. Dozens of companies are building here, each focused on different geographic regions, use cases (e.g. international payroll, import/export businesses, remittances), and transaction sizes. Differentiation at this layer varies in some aspects (depending on use case), but each company at this layer constantly assesses the rest of their stack to build a platform that is as efficient, dynamic, and low-cost as possible.

3. On/Off-Ramps and Liquidity Providers

What they do: Provide the bridge between traditional finance and the stablecoin economy. They enable individuals and institutions to move money in and out of stablecoins.

Examples: FalconX markets itself as a prime brokerage in this space. Bitso focuses on Latin America and Coinbase on the U.S. – both have major market share in their respective regions and operate big consumer businesses, as well.

Business model: Conversion fees, lending and liquidity yield, and spread-based pricing.

Opportunity: I mentioned above that stablecoins provide the potential for significantly reduced cross-border payment fees – but we’re not quite there yet.

Behind each of these slick front-end products are massive capital markets networks. Players rely on banks, hedge funds, and other liquidity providers to transact in as low-cost a manner as possible.

Deposits into these platforms are heavily skewed towards reserve currencies and away from emerging market currencies, typically by an order of magnitude, or greater. E.g. for remittances, a primary stablecoin use case, consumers in the U.S. are depositing USD, converting to stables, and sending stables back to family & friends in emerging markets, who convert back to local currency. At that last step, the platform has to rely on third parties to make markets with potentially wide spreads, thus driving up transaction costs and undermining stablecoin efficacy.

Therefore, a big component of success and differentiation for these platforms lies in integrating the right capital markets partners, which is quite difficult – it requires international licenses, sophisticated FX spot & derivative trading expertise, relationships with the right institutions, and building the optimal platform to transact with the right partner at the correct moment.

Earlier stage companies like XFX and Stable Sea are trying to solve this problem, partnering with front-end platforms and working to build large enough global networks such that they can lower the end cost of transacting across stables & fiat. As these capital markets become more efficient and globally connected, the cost of transacting in stablecoin will decrease, further driving stablecoin use cases and adoption.

4. Orchestration Platforms

What they do: Connect multiple infrastructure services – wallets, compliance, payments, and liquidity – into one API-driven platform so businesses don’t need to build in-house.

Examples: Zerohash and Bridge illustrate the growing demand for orchestration. These companies make it easy for fintechs, banks, or platforms to launch stablecoin-powered products.

Business model: Monetized through API calls and white-labeled infrastructure.

Overview: Orchestration platforms in the stablecoin ecosystem are in many ways analogous to traditional payfacs in the fiat world. These are highly complex infrastructure businesses that require extensive builds. Success here depends on deep integrations across chains, KYC/AML providers, and compliance tooling. Distribution is critical – once embedded, orchestration platforms benefit from high switching costs. As with other infrastructure businesses across sectors, companies who succeed at this layer of the stack have strong ability and incentive to move into adjacent layers. Stripe’s Open Issuance platform is one such example, as Bridge looks to monetize at the Issuer level.

5. Wallets and Custodians

What they do: Serve as the secure gateway for institutions and enterprises to store, send, and manage stablecoins. Wallets are not just technical tools but trust-based infrastructure.

Examples: Fireblocks was most recently valued at $8B – they service hedge funds, banks, and trading firms. Emerging players like Utila are building more modern, composable infrastructure that is particularly valuable for SMBs looking for off-the-shelf stablecoin sophistication. Custodians like Anchorage Digital and fintech-integrated wallets from Coinbase also play a role here.

Business model: Fees based on assets under custody, plus premium features such as Multi-Party Computation (MPC) security, governance tools, and insurance.

Opportunity: Wallets are capital-intensive and complex to build – they require regulatory approvals, top-tier cybersecurity, and undergo heavy compliance obligations. Success here requires teams that have the right blend of financial nous, cybersecurity expertise, and global reach. Bigger banks may try to build here, especially now that they have greater regulatory clarity, but many will find it difficult and expensive to create a secure, composable platform that is on par with some of the companies built explicitly for this space.

Regulatory Tailwinds: The Era of Clarity

Until recently, regulation was the biggest barrier to institutional adoption. That is changing in the world’s biggest markets:

In Europe, the MiCA (Markets in Crypto-Assets) framework, passed in 2023, and fully put into effect at the end of 2024, gave stablecoins their first comprehensive regulatory home. MiCA sets clear rules around licensing, reserves, and disclosures, creating a unified regime across all EU member states. Key requirements include:

1:1 cash reserves, holding “prudential capital,” and managing liquidity risks

Whitepapers for issuers

Crypto-asset service providers (CASPs) must fulfill governance, risk, and compliance standards, and adhere to market abuse and transparency rules

MiCA also introduces passporting (a license in one member state allows operation across all) and harmonizes oversight by national regulators.

In the U.S., the GENIUS (Guiding and Establishing National Innovation for U.S. Stablecoins) Act, signed into law in July 2025, had a similar effect – it set the first U.S. federal framework for stablecoins. Key requirements include:

Only “qualified” issuers may issue

1:1 collateral in cash/short-dated Treasuries

Monthly reserve disclosures and audits

Integration with AML/CTF rules

Preemption of state money-transmitter laws

No direct yield or interest permitted

The GENIUS Act places stablecoins firmly under banking and financial oversight – not securities or commodities law.

Banks, payment companies, and corporates now have a clear path to adopt stablecoins without regulatory uncertainty. A recent Fireblocks survey found that while fewer than 25% of institutions have used stablecoins for over a year, 90% are actively preparing adoption.

Why Now?

Stablecoins are trending towards inevitable adoption. The technology has proven itself; the regulatory frameworks are in place; institutional interest is accelerating. Yet the infrastructure that will power the ecosystem is far from standardized.

The next wave of opportunity lies in building the rails, wallets, and orchestration platforms that will allow stablecoins to scale into trillions of dollars in monthly flows. These winners will be the “Plaid” or “Stripe” equivalents of digital assets – embedding themselves into global financial infrastructure for decades.

That’s exactly why Stripe acquired Bridge in the first place: who better to be the Stripe of stablecoins than Stripe itself - they certainly understand the breadth of the market opportunity. But Stripe also wants to be the Stripe of agentic payments (more on that in another piece), continue building within traditional fiat rails, and more. They’ll be a big player in stablecoins, but the market is large, and with an order of magnitude of transaction volume growth coming over the next few years, there’s still plenty to build for.

Consider these questions: When will we start seeing cross-border factoring in stables? How does stablecoin growth impact the financial derivatives markets across rates & FX? When do emerging markets develop the technology to transact locally in stablecoins at scale, and how will that affect their government policies and central bank strategies?

A year removed from Stripe’s acquisition of Bridge, it’s clear stablecoins are here to stay. The winners of this next era will play a central role in driving money movement for the global economy. The firms that combine security, compliance, and ease of use will create the backbone for programmable payments, treasury, and beyond.