Thinking Big vs. Thinking Small

The pace at which AI is moving feels very Big. But those who focus on the Small Stuff are in position to build the next era of venture-scale companies.

2026 is shaping up to be one of the most consequential years in recent tech history. With Claude Cowork launching plug-ins and other related developments, publicly traded “legacy” SaaS companies are trading down precipitously in what some are branding as the SaaSpocalypse.

People from every corner of the tech world have come out to share their opinions, and there have been some very thought-provoking points of view on what’s going on that are worth highlighting. Matt Shumer wrote Something Big Is Happening – tech people mostly read it and thought “this is directionally accurate;” non-tech people mostly read it and gulped about what’s coming next. Nicolas Bustamante put together a strong framework for how to think about the future of vertical SaaS. Both are worth reading – both tackle really Big subjects.

On the other hand, my weekly posts in this Substack mostly focus on Small Stuff – specific verticals and sub-verticals, “niche” idiosyncrasies in industries that present problems that tech can solve for.

But if Shumer is right that “Something Big Is Happening” (and I think he directionally is), then why focus on the Small Stuff at all?

Because the Small Stuff becomes really Big when you understand a domain and appreciate how to use new technology to solve old problems.

The Services Economy and SMB’s Role Within It

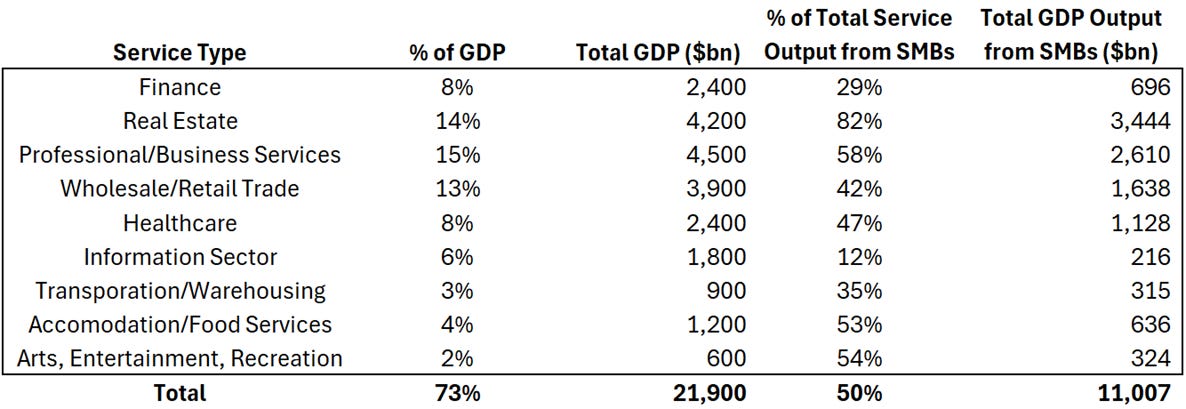

Per the St. Louis Fed, services-based businesses make up ~73% of U.S. GDP – a number that has risen steadily since the turn of the millennium, when services made up ~66% of U.S. GDP. Let’s dig into each segment of the services economy, and also highlight SMB (small-to-medium business)’s role within each, thanks to data from the U.S. Small Business Administration Office of Advocacy:

2025 U.S. GDP was approximately $30 trillion. $22 trillion of that came through services businesses; $11 trillion from SMBs providing those services.

SMBs have never been venture-backable, by definition. Venture capital needs large outcomes, not small-to-medium ones. That’s why the two most venture-friendly sectors of the last 30 years – Finance (29% output from SMBs) and the Information Sector (12%) – are the sectors with the lowest SMB concentration. In the 1990s, roughly 42% of Finance GDP and 25% of Information GDP came from SMBs. Then fintech and SaaS showed up, consolidated a large portion of those industries, and built the new enterprises we know today.

Other industries have been slower to consolidate… but that’s about to change.

Why Now is the Time to Invest in Early-Stage Companies

Fintech and SaaS were ripe for disruption in previous cycles because of cloud and mobile. Those platforms enabled payments infrastructure, horizontal SaaS like CRM/HCM, and early vertical SaaS; tools that solved the first layer of general SMB workflows.

AI is the platform shift that powers the second, much deeper layer of general workflows - work that requires flexibility and some degree of judgment: customer service, scheduling, bookkeeping, new business prospecting, and much more. That means it can go after a much larger swath of the services economy than cloud or mobile ever could.

The reason many services sectors have historically been SMB-heavy is specificity. Specificity of skill set, specificity of geography, specificity of brand, and more. Consider the tangible example of real estate. A property management company in Phoenix operates very differently from one in Boston – different climate, regulatory codes, market dynamics, tenant expectations. That specificity is hard to scale, so the industry stays fragmented.

Specificity is the root of differentiation. It’s in the specific workflows, relationships, and data that businesses differentiate themselves – even within the same sub-category.

But AI is powerful enough to normalize the general aspects that services companies provide. By handling the commodity work, AI lets small operators focus entirely on the specific things they’re uniquely good at. And it lets them do more of it, faster, with fewer people. Just as traditional fintech & SaaS solutions did in the previous cycles.

A caveat worth mentioning: AI can certainly do specific things, too. But it cannot fake network effects, brand recognition, or proprietary data – and more importantly, even as it figures out how to synthetically replicate some aspects of each, the companies that already have a leg up can compound their advantage in the meantime if they continue effectively utilizing bleeding edge technology.

The most formidable companies in this cycle will combine elite domain expertise with a willingness to incorporate bleeding edge AI.

I’m particularly excited about the big 4 areas of the chart above which produce large shares of GDP and have large SMB output – real estate, professional/business services, wholesale/retail trade, and healthcare, which make up almost $9 trillion of SMB GDP between them. We’ll see dozens of major, venture-backable outcomes in each over the course of this cycle.

What Comes Next

While SMBs haven’t historically been venture-backable, some of them will be in this new era. There is no standard definition of what makes a business an SMB vs an enterprise. Some bucket by headcount (e.g. <500 employees), and others bucket by revenue (e.g. <$50mm annually). AI will certainly allow for smaller teams to reach larger scale – it will also allow lower revenue companies to reduce overhead, increase EBITDA margin, and trade at higher revenue multiples that support venture-like outcomes.

Companies will take different paths to get there. Some SMBs will be more efficient by using third-party AI tools. Others will build AI-native companies from scratch that allow a smaller number of employees to cover a wider range of specific tasks. Both groups are venture-backable.

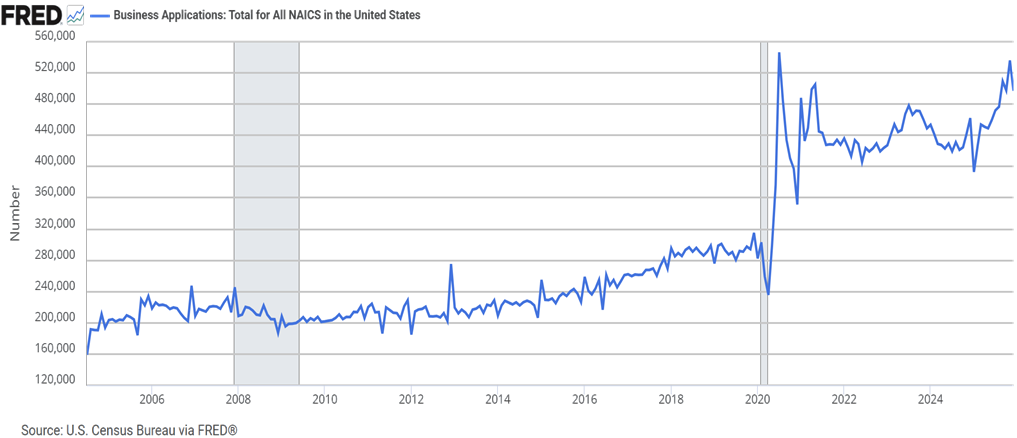

And the good news for me and other early-stage venture investors is that, new company formation has never been higher. The U.S. has experienced sustained ~50% growth in new business applications relative to pre-pandemic levels, thanks to:

Remote work

Unprecedented levels of financial stimulus from the U.S. Government

Labor market dynamics & “The Great Resignation”

Sector-specific opportunities for new business creation

This means more customers looking for AI solutions, and more builders for every sub-vertical.

Thinking Small While Understanding Big

AI is Big – it magnifies the value of individuals with specific expertise. This creates a massive economic opportunity for the top 5-10% of professionals who understand how to use AI tools effectively within their field. It’s why I write so much about AI: I try to help readers use their imaginations to understand what is possible with AI. It’s also why I’m so bullish on early-stage companies: vertically-integrated and “niche” companies – that in another era would’ve been Small – can now create venture outcomes. That was impossible 5 years ago.

There will be AI-native companies across every category and sub-category, and there will be AI-native companies in entirely new fields which get created because human beings adapt to a quickly changing world. And when it comes to building in the era of AI, just like in every other cycle, the smartest, hardest-working individuals who build the best networks in their field will be the most successful – and they’ll be successful on a larger scale, and across more areas of the economy, than in previous cycles.

That’s why it’s so important to think “Small” while understanding what’s going on at the bleeding edge of AI.

Next week, I’ll be back to discussing some of these Small ecosystems.